Free Equities SEC Rule 605 Stock Database

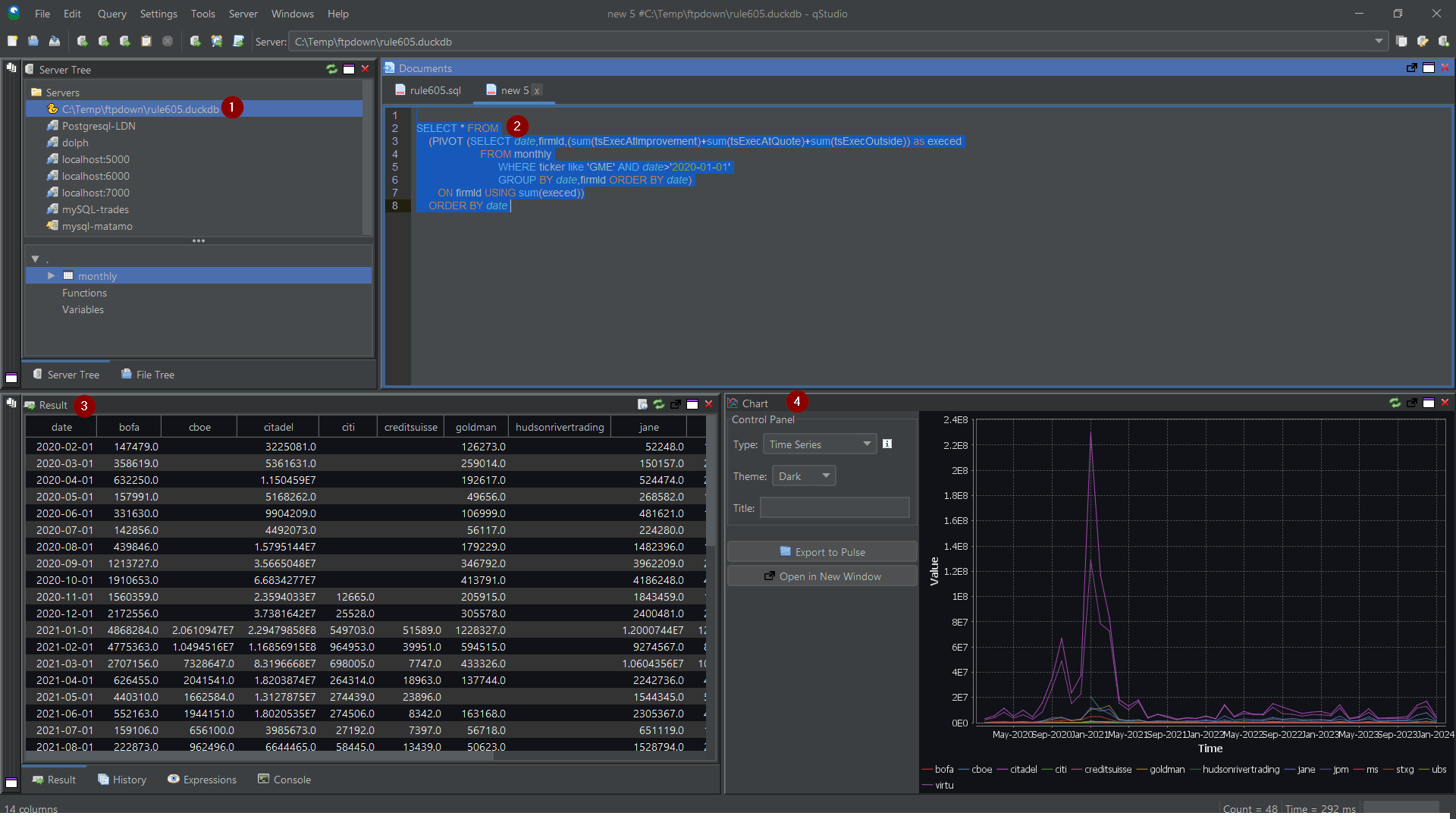

Per Rule 11Ac1-5, the SEC mandates market centers that trade national market system securities to submit monthly electronic reports. We have gathered that messy data into one easy to use database for you. To query it, download the .duckdb data file, install QStudio and then open the .duckdb file. The .duckdb file can also be queried easily from python.

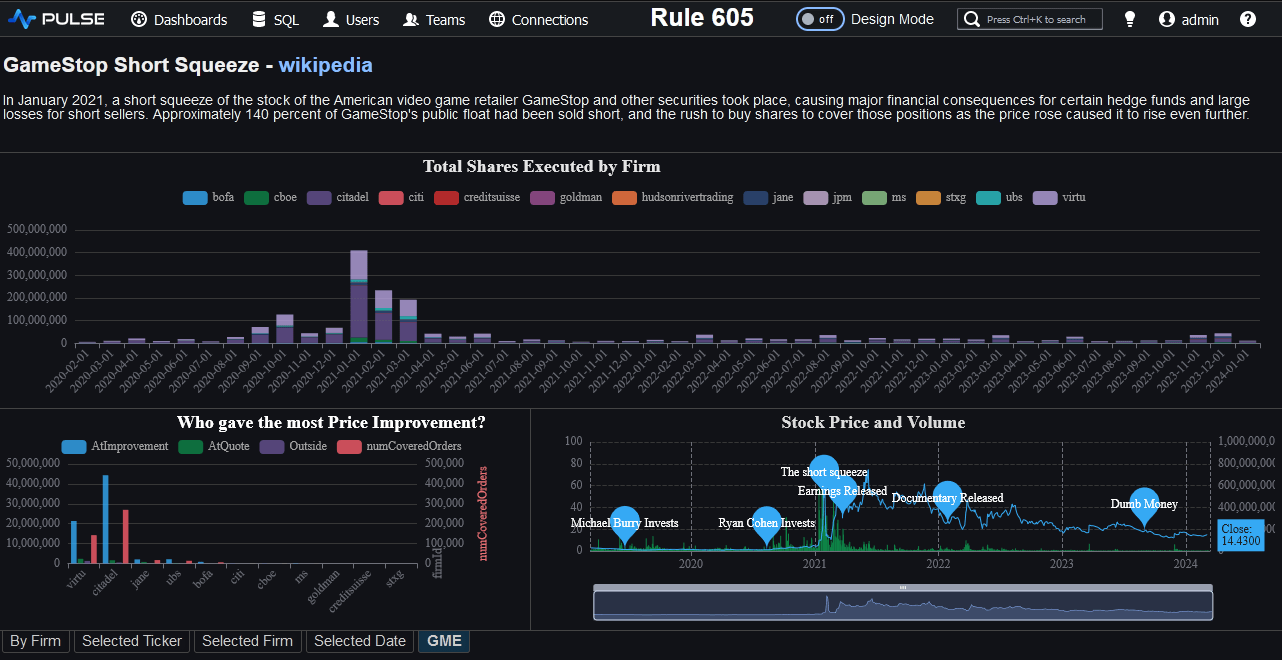

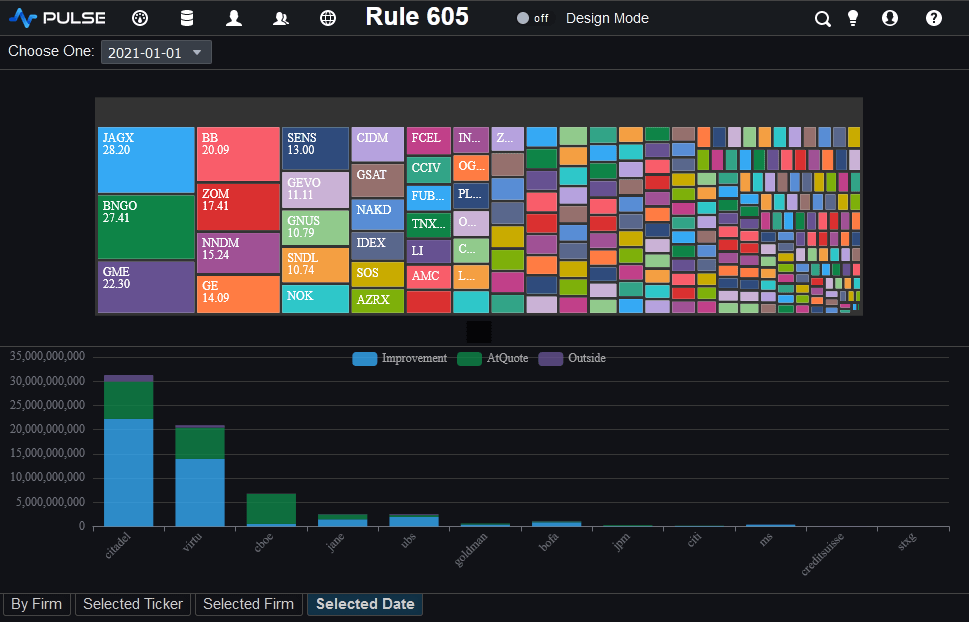

Example Analysis

These screenshots are from Pulse, Pulse is a tool to create interactive data applications quickly.

Opening Data

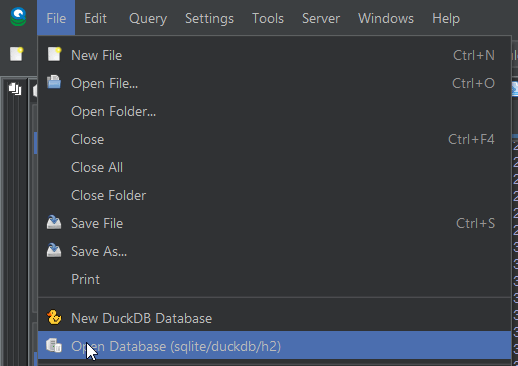

To open the data:

- Download rule605.duckdb (2.7GB)

- Download QStudio Free SQL IDE

- Open QStudio and go to the File Menu -> Open Database (shown in image below)

- Enter a query into the editor, highlight the query, then press Ctrl+E to run that code

Data Sources

The data was downloaded from the following data sources:

- Citadel TCDRG

- Virtu

- CBOE

- Goldman Sachs TGSCO

- BofA Securities, Inc. TMLCO

- Citigroup TSBSH

- Morgan Stanley TMSCO

- Two Sigma Securities TSOHO

- Jane Street TJNST

- National Financial Services TNFSC

- Susquehanna TETMM

- Credite Suisse TFBCO

- UBS TUBSA

- WOLVERINE SECURITIES, LLC TWSEA

- Wallstreet Access TVNDM

- Raymond James & Associates TRAJA

- Canaccord Genuity LLC CSTI TCSTI

605 File Structure

Reports for Rule 605 always have the SEC documented file structure

The below example in particular shows Citadel trades for (202401) January 2024 for the ticker AA with each row recording a different orderType/orderSize combination.

| Column | Title | Description |

|---|---|---|

| 1 participantId | Participant ID | (Amex - "A"; BSE - "B"; CHX - "M"; CSE - "C"; NASD - "T"; NYSE - "N"; PCX - "P"; Phlx - "X".) |

| 2 marketId | Market Center ID | |

| 3 month | Calendar Month | ("yyyymm") |

| 4 ticker | Securities Ticker | |

| 5 orderType | Order Type Code | ("11"; marketable limit orders - "12"; inside-the-quote limit orders - "13"; at-the-quote limit orders - "14"; near-the-quote limit orders - "15".) |

| 6 orderSize | Order Size Code | (The order size codes are as follows: 100-499 shares - "21"; 500-1999 shares - "22"; 2000-4999 shares - "23"; 5000 or more shares - "24".) |

| 7 numCoveredOrders | Number of Covered Orders | |

| 8 tsCoveredOrders | Total shares of covered orders (TSoCE) | |

| 9 tsCancelled | TSoCE cancelled prior to execution | |

| 10 tsExecutedCentre | TSoCE of covered orders executed at the receiving market center | |

| 11 tsExecutedOther | TSoCE of covered orders executed at any other venue | |

| 12 tsExec9 | TSoCE (0 - 9 seconds after receipt) | |

| 13 tsExec29 | TSoCE (10 - 29 seconds after receipt) | |

| 14 tsExec59 | TSoCE (30 - 59 seconds after receipt) | |

| 15 tsExec299 | TSoCE (60 - 299 seconds after receipt) | |

| 16 tsExec30m | TSoCE (5 minutes - 30 minutes after receipt) | |

| 17 avgRealizedSpread | Average realized spread for executions of covered orders | (expressed in dollars and carried out to four decimal places) |

| 18 avgEffectiveSpread | Average effective spread for executions of covered orders | (expressed in dollars and carried out to four decimal places) |

| 19 tsExecAtImprovement | Total shares of covered orders executed with price improvement | |

| 20 swAvgPerShareImprovement | Share-weighted (SW) average amount per share that prices were improved | (expressed in dollars and carried out to four decimal places) |

| 21 swImprovementExecDelayTime | Share-weighted average period from the time of order receipt to the time of order execution | (expressed in number of seconds and carried out to one decimal place) |

| 22 tsExecAtQuote | Total shares of covered orders executed at the quote | |

| 23 swAtQuoteExecDelayTime | Share-weighted average period of time from the time of order receipt to the time of order execution | (expressed in number of seconds and carried out to one decimal place) |

| 24 tsExecOutside | Total shares of covered orders executed outside the quote | |

| 25 swAvgPerShareOutside | Share-weighted average amount per share that prices were outside the quote | (expressed in dollars and carried out to four decimal places) |

| 26 swOutsideExecDelayTime | Share-weighted average period of time from the time of order receipt to the time of order execution | (expressed in number of seconds and carried out to one decimal place) |